July 27, 2017

Dear Daily Pfennig Readers…

It’s our pleasure to be here, filling in for our dear friend Chuck Butler while he’s on vacation.

To introduce ourselves, we’re Mary Anne and Pamela Aden. We write The Aden Forecast letter, and we’ve been happily doing this for 36 years. We cover the major markets, and we’ll be posting some of our articles here.

We also publish Dow Theory Letters. It was founded by the late great Richard Russell and, along with a team of top notch writers, we’ve carried on with his work. Some of these articles will also be posted during Chuck’s R&R.

And finally, you’ll also be receiving articles from GoldChartsRUs, our weekly trading service. Here our top trader covers what to buy, what to avoid, what to do about it and much more.

We hope you enjoy our articles while Chuck’s away.

Chuck’s transition is complete and we’re proud to have him as part of our Aden Group.

Best regards and here’s to good markets,

Mary Anne & Pamela Aden

Today we’re posting from The Aden Forecast Weekly Update.

EXCITING MARKETS

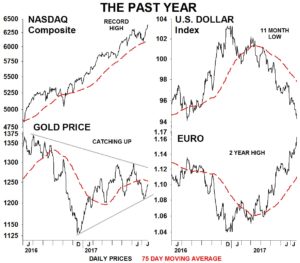

Gold, silver and gold shares jumped up to a several week high today. And gold has had its longest winning streak in two months. It now looks like the six week decline we call ‘B’ is over (see chart). This will be reinforced if the dollar remains weak and if they now stay above $1225 for gold, $16 for silver and 80 for the XAU gold share index.

Once the C rise heats up, it’ll be very telling about the overall strength of the market. A very bullish C rise would be clearly underway once it surpasses last year’s peak near $1375. This would be a milestone.

Silver’s flash sale was short lived. Platinum is also bouncing up from a key support level, and it’s adding to the stable of firmness.

The commodities are looking better. Copper and crude are on the rise, and they have room to rise further. Keep your positions, and buy if you want to add to your positions.

The falling U.S. dollar index has helped boost commodities. And with sluggish long interest rates while Yellen suggests that rates could stay unchanged this year, it all helped to put pressure on the dollar. The dollar index is at an 11 month low while the currencies soar.

The euro, Swiss franc, Australian and Canadian dollars have all surged this week. And today’s surprise move was due to ECB president Draghi who pledged to continue the ECB’s asset-purchasing plan through December or beyond. So the euro jumped to a two year high (see chart). Keep your positions.

Nasdaq and the S&P500 shot-up, reaching another record high, along with some of the other indexes earlier this week (see chart). The stock market remains strong and robust, and earnings season is looking positive.

The S&P500 is very bullish by staying above 2410 and the global stock markets are strong and bullish too. Our recommended stocks are doing well. Keep your positions.

T-Bills (90-day) rose clearly above 1% this week for the first time in years, while long-term yields are sluggish. But increasingly, long-term interest rates will likely soon be following short-term rates up. That is, bond prices are headed lower and it’s best to avoid bonds and stay on the sidelines.

For more information about The Aden Forecast, click here.